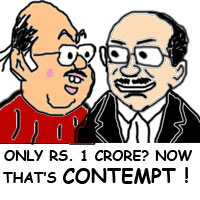

The author raises the seminal question as to why, while the Tribunal has all the trappings of a Court, does it not have the power to punish for contempt. He cautions lower authorities that the lack of contempt power is no reason for not following the binding judgements of the Tribunal. He also makes a fervent plea to all practitioners to uphold the honour & dignity of the great Institution.

Under the Income tax Act, the Income Tax Appellate Tribunal is a final fact finding authority. In Ajay Gandhi v B. Singh (2004) 265 ITR 451 Apex Court observed that “The Income tax Appellate Tribunal exercises judicial functions and has the trapping of a Court”. Apex Court in ITAT v V.K. Agrawal (1999) 235 ITR 175 has held that interfering with administration of justice of the Income Tax Appellate Tribunal will amount to contempt of Court. In an historic judgment then law secretary was held for contempt. It is now beyond doubt that the Income tax Appellate Tribunal has all the powers of Court. It can issue summons and exercise all the powers vested in the Income tax authorities under section 131 of the income Tax Act, hence any proceedings before the Income tax Appellate Tribunal shall be deemed to be judicial proceedings within the meaning of sections 193 and 228 for the purpose of section 196 of the Indian Penal code. The Tribunal shall be deemed to be a Civil Court for all the purposes of section 195 and Chapter XXXV of the Code of Criminal Procedure 1898.

To resent the questions asked by a judge, to be disrespectful to him, to question his authority to ask questions, to shout at him, to threaten him with transfer and impeachment, to use insulting language and abuse him, to dictate the order that he should pass, to create scenes in the Court, to address him by losing temper area all acts calculated to interfere with and obstruct the course of justice

Under the Contempt Courts Act 1971 “Civil contempt” is defined in section 2 (b) “Civil contempt” means willful disobedience to any judgment, direction, orders writ, process of a Court”. The Court is not defined under the Contempt Courts Act 1971. The Income tax Appellate Tribunal therefore is also competent to initiate contempt proceedings, however, it has no power to punish for its contempt. Judicial discipline demands that authorities subordinate to the Income tax Appellate Tribunal must accept as binding decisions of the Tribunal. In Khalid Automobiles v UOI (1995) 4 SCC (Suppl) 652, the Court held that an order of Tribunal was binding on the assessing Officer and the first Appellate authority and the failure to follow the same may constitute contempt of Tribunal’s order (Refer Rajendra Mills Ltd v Jt CIT (1971) 28 STC 483 (Mad), Senthil Raj Metal v GTO (1990) 79 STC 38 (Mad) and UOI v Kamalakshi Finance Corporation Ltd AIR 1992 SCC 711 (712). It is desired that in an appropriate case the Income tax Appellate Tribunal may take an appropriate step for contempt for not following the binding nature of the order of Income Tax Appellate Tribunal by lower authorities so that judicial discipline is maintained.

In a land mark decision the Apex Court in Re: Vinay Chandra Mishra (1995) 2 Supreme Court cases 584, a senior Advocate held to be guilty of contempt for making certain allegation and threatening to transfer a presiding judge. In a letter to Chief justice the Judge concerned wrote as under (594) “It is not the question of insulting of a judge of this institution but it is a matter of institution as a whole. In case dignity of Judiciary is not being maintained then where this institution will stand. In case a Senior advocate, President of Bar and Chairman of Bar Council of India behaves in Court in such manner what will happen to other advocates”. While dealing with the issues the Apex Court has made certain important observations which deserves to remembered by all the concerned who represent before the Income Tax Appellate Tribunal or Court, to maintain dignity and honour of the Institution. The Apex Court observed that at 614. “No one expects a lawyer to be subservient to the Court while presenting his case and not to put forward his arguments merely because the Court is against him. In fact, that is the movement when he is expected to put forth his best effort to persuade the Court. However, if, in spite of it, the lawyer finds that the Court is against him, he is not expected to be discourteous to the Court or to fling hot words or epithets or use disrespectful, derogatory or threatening language or exhibit temper which has the effect of overbearing the Court. Cases are won and lost in the Court daily. One or other side is bound to lose. The remedy of the losing lawyer or the litigant is to prefer an appeal against the decision and not to indulge in a running battle of words with the Court. That is the least that is expected of a lawyer. Silence on some occasions is also an argument. The lawyer is not entitled to indulge in unbecoming conduct either by showing his temper or using unbecoming language”.

Role expected of a lawyer representing the interests of his client and as an officer of the Court. All who represent before the Income tax Appellate Tribunal whether they are lawyers, Chartered accountants or departmental representatives must follow the principle laid down by the Apex Court to maintain the dignity and honour of the institution

The Apex Court at P 616 also made following Observations “To resent the questions asked by a judge, to be disrespectful to him, to question his authority to ask questions, to shout at him, to threaten him with transfer and impeachment, to use insulting language and abuse him, to dictate the order that he should pass, to create scenes in the Court, to address him by losing temper area all acts calculated to interfere with and obstruct the course of justice. Such acts tend to overawe the Court and to prevent it from performing its duty to administer justice”.

The Court also observed that “Brazenness is not outspokenness and arrogance is not fearlessness. Use of intemperate language is not assertion of right nor is a threat an argument. Humility is not servility and Courtesy and politeness are not lack of dignity. Self–restraint and respectful attitude towards the Court, presentation of correct facts and law with a balanced mind and without overstatement, suppression, distortion, or embellishment are requisites of good advocacy. A lawyer has to be a gentleman first. His most valuable asset is respect and goodwill he enjoys among his colleagues and in the Court”.

Role expected of a lawyer representing the interests of his client and as an officer of the Court. All who represent before the Income tax Appellate Tribunal whether they are lawyers, Chartered accountants or departmental representatives must follow the principle laid down by the Apex Court to maintain the dignity and honour of the institution. It may so happen that too much aggressiveness and disrespect to the bench and institution may lead to Contempt Proceedings. If the judiciary is to perform its duties and functions effectively and remain true to the spirit with which they are sacredly entrusted to it, the dignity and the authority of the Courts have to be respected and protected at all costs. Otherwise, the very cornerstone of our constitutional scheme will give way and with it will disappear the rule of law and the civilized life in the society. As per the Contempt of Courts Act 1971 a reference can be made by the subordinate Court to the High Court in respect any contempt. The Tribunal being subordinate to the High Court can make a reference to the High Court in an appropriate case following due process of law. In this regard the CAT has specific rules i.e. The Contempt of Court (C.A.T.) Rules 1992 whereby the CAT exercise the powers conferred by the Contempt of Courts Act, 1971, similar power is also conferred on the proposed National Tax Tribunal, however such powers are not conferred to the ITAT. Let us make an honest attempt to preserve the Honour and dignity of the Institution while making representation before the Income Tax Appellate Tribunal and Court.

Dr. K. Shivaram

![]()

Editor in Chief, AIFTP & President, ITAT Bar Association

Reproduced with permission from the AIFTP Journal, April 2011